Southern Silver Exploration Corp. (TSX.V: SSV) (“Southern Silver”) reported today initial assay results from its 10,000 metre 2020-21 core drilling program on the Cerro Las Minitas project, Durango State, Mexico which included intervals of strongly silver-enriched semi-massive to massive sulphide mineralization in drill hole 20CLM-119.

Assay highlights include:

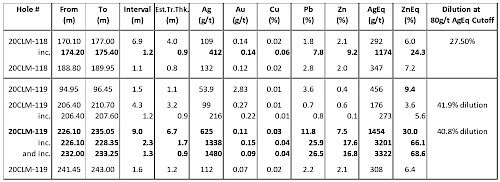

- a 9.0m down hole interval (6.7m est. True Thickness) averaging 625g/t Ag, 11.8% Pb and5% Zn (1,454g/t AgEq; 30.0% ZnEq) including a higher grade 2.3m interval (1.7m est. TT) averaging 1,338g/t Ag, 25.9% Pb and 17.6% Zn (3,201g/t AgEq; 66.1% ZnEq) from drill hole 20CLM-119; and

- a 6.9m down hole interval (4.0m est. TT) averaging 109g/t Ag, 1.8% Pb and1% Zn (255g/t AgEq; 7.2% ZnEq) including a higher grade 1.2m interval (0.9m est. TT) averaging 412g/t Ag, 7.8% Pb and 9.2% Zn (1,174g/t AgEq; 24.3% ZnEq) from drill hole 20CLM-118.

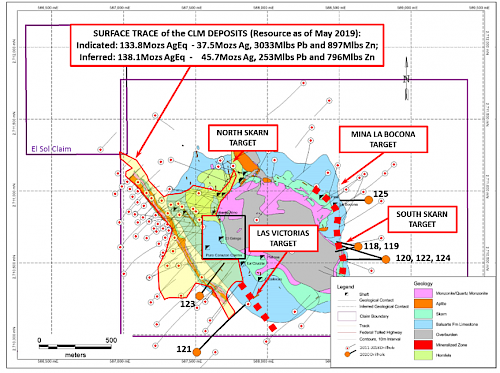

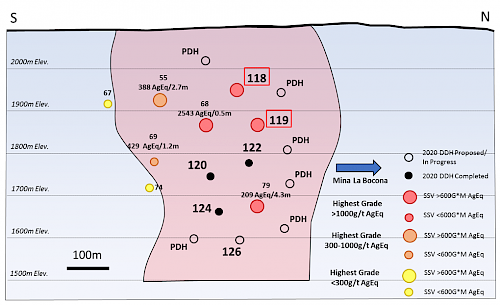

The two drill holes are the first results in 2020 for the South Skarn target, which extends for over 500 metres of strike on the eastern side of the Cerro and has been tested to depths of over 450 metres. The South Skarn target is approximately 1 kilometre away from the known mineral deposits currently identified on the property. The holes are lateral and up-dip step-outs from previously reported mineralization in hole 13CLM-68 which returned 13.9 metres (8.4m est. TT) of 136g/t Ag, 2.4% Pb and 1.3% Zn (326g/t AgEq; 6.3% ZnEq; see NR-15-13) and establish the continuity of mineralization in the shallower parts of the South Skarn zone. Five holes totaling 2,191 metres have now been completed on the South Skarn target. Several additional holes are planned which will test the target to depths of up to 600 metres below surface.

Rob Macdonald, Vice President Exploration stated: “The mineralization identified in 20CLM-119 is comparable in both grade and thickness to several mineralized intercepts previously identified by Southern Silver at the South Skarn and Bocona targets in drilling between 2011 to 2015 and provides confidence in our targeting as we work to continue expanding the mineral resource base at the Cerro Las Minitas project.”

Approximately 3,700 metres of drilling has been completed of an anticipated 10,000 metres of core drilling for the 2020-21 exploration program. Drilling continues with one drill focused on the South Skarn target and a second drilling currently drilling the Mina La Bocona target. Two drill holes have been completed on the Las Victorias target.

Drilling on the east side of the Cerro will test an approximate 800 metre strike length of the Skarn Front and Mina La Bocona mineralized zones to depths of up to 650 metres as well as a high-grade hanging wall zone in the Mina La Bocona target area. The targeting is designed to increase the current mineral resource estimate by approximately 30%. The CLM Project remains one of the larger undeveloped silver-lead-zinc projects in the world and is both fully financed and fully permitted.

Figure 1: Plan Map of the Area of the Cerro showing the distribution of the CLM deposits and the location for new drill targeting, at the Mina La Bocona, South Skarn and Las Victorias targets.

Figure 2: Longitudinal section of proposed, current and past drilling on the South Skarn target.

Table 1: Select Assay intervals from the South Skarn Target areas

Analyzed by FA/AA for gold and ICP-AES by ALS Laboratories, North Vancouver, BC. Silver (>100ppm), copper, lead and zinc (>1%) overlimits assayed by ore grade ICP analysis, High silver overlimits (>1500g/t Ag) and gold overlimits (>10g/t Au) re-assayed with FA-Grav. High Pb (>20%) and Zn (>30%) overlimits assayed by titration. AgEq and ZnEq were calculated using average metal prices of: US$17/oz silver, US$1450/oz gold, US$2.8/lbs copper and US$0.95/lbs lead and US$1.20/lbs zinc. AgEq and ZnEq calculations did not account for relative metallurgical recoveries of the metals. Ore-grade composites calculated using a 80g/t AgEq cut-off and <20% internal dilution, except where noted; anomalous intercepts calculated using a 10g/t AgEq cut-off.

Cerro Las Minitas Project

The Cerro Las Minitas project is an advanced exploration stage polymetallic Ag-Pb-Zn-Cu Skarn/CRD project located in southern Durango, Mexico.

The Cerro Las Minitas project as of May 9th, 2019 contains a Mineral Resource Estimate, at a 175g/t AgEq cut-off, of(1)

- Indicated – 134Moz AgEq: 5Moz Ag, 40Mlb Cu, 303Mlb Pb and 897Mlb Zn

- Inferred – 138Moz AgEq: 45.7Moz Ag, 76Mlb Cu, 253Mlb Pb and 796Mlb Zn

A total of 133 drill holes for 59,000 metres have been completed on the CLM Project with exploration expenditures of approximately US$25.5 million equating to exploration discovery costs of approximately C$0.09 per AgEq ounce to the end of 2019.

About Southern Silver Exploration Corp.

Southern Silver Exploration Corp. is an exploration and development company with a focus on the discovery of world-class mineral deposits. Our specific emphasis is the 100% owned Cerro Las Minitas silver-lead-zinc project located in the heart of Mexico’s Faja de Plata, which hosts multiple world-class mineral deposits such as Penasquito, Los Gatos, San Martin, Naica and Pitarrilla. We have assembled a team of highly experienced technical, operational and transactional professionals to support our exploration efforts in developing the Cerro Las Minitas project into a premier, high-grade, silver-lead-zinc mine. The Company engages in the acquisition, exploration and development either directly or through joint-venture relationships in mineral properties in major jurisdictions. Our property portfolio also includes the Oro porphyry copper-gold project located in southern New Mexico, USA.

- The 2019 Cerro Las Minitas Resource Estimate was prepared following CIM definitions for classification of Mineral Resources. Resources are constrained using mainly geological constraints and approximate 10g/t AgEq grade shells. The block models are comprised of an array of blocks measuring 10m x 2m x 10m, with grades for Au, Ag, Cu, Pb, Zn values interpolated using ID3 weighting. Silver and zinc equivalent values were subsequently calculated from the interpolated block grades. The model is identified at a 175g/t AgEq cut-off, with an indicated resource of 11,102,000 tonnes averaging 105g/t Ag, 0.10g/t Au, 1.2% Pb, 3.7% Zn and 0.16% Cu and an inferred resource of 12,844,000 tonnes averaging 111g/t Ag, 0.07g/t Au, 0.9% Pb, 2.8% Zn and 0.27% Cu. AgEq cut-off values were calculated using average long-term prices of $16.6/oz. silver, $1,275/oz. gold, $2.75/lb. copper, $1.0/lb. lead and $1.25/lb. zinc. Metal recoveries for the Blind, El Sol and Las Victorias deposits of 91% silver, 25% gold, 92% lead, 82% zinc and 80% copper and for the Skarn Front deposit of 85% silver, 18% gold, 89% lead, 92% zinc and 84% copper were used to define the cut-off grades. Base case cut-off grade assumed $75/tonne operating, smelting and sustaining costs. All prices are stated in $USD. Silver Equivalents were calculated from the interpolated block values using relative recoveries and prices between the component metals and silver to determine a final AgEq value. The same methodology was used to calculate the ZnEq value. Mineral resources are not mineral reserves until they have demonstrated economic viability. Mineral resource estimates do not account for a resource’s mineability, selectivity, mining loss, or dilution. The current Resource Estimate was prepared by Garth Kirkham, P.Geo. of Kirkham Geosciences Ltd. who is the Independent Qualified Person responsible for presentation and review of the Mineral Resource Estimate. All figures are rounded to reflect the relative accuracy of the estimate and therefore numbers may not appear to add precisely.

Robert Macdonald, MSc. P.Geo, is a Qualified Person as defined by National Instrument 43-101 and supervised directly the collection of the data from the CLM Project that is reported in this disclosure and is responsible for the presentation of the technical information in this disclosure.

On behalf of the Board of Directors

“Lawrence Page”

Lawrence Page, Q.C.

President & Director, Southern Silver Exploration Corp.

For further information, please visit Southern Silver’s website at southernsilverexploration.com or contact us at 604.641.2759 or by email at ir@mnxltd.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains forward-looking statements. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. Factors that could cause actual results to differ materially from those in forward looking statements include the timing and receipt of government and regulatory approvals, and continued availability of capital and financing and general economic, market or business conditions. Southern Silver Exploration Corp. does not assume any obligation to update or revise its forward-looking statements, whether as a result of new information, future events or otherwise, except to the extent required by applicable law.